Software Escrow Definition & Types Of Escrow

What Is Software Escrow?

Understanding Software Escrows and Technology Escrows is essential for modern businesses navigating the complex terrain of software development and licensing agreements. In this comprehensive guide, we delve into the key components that form a software escrow arrangement, introducing the three main parties involved – the Developer, Beneficiary, and Escrow Agent. We also explore the critical elements such as Deposit Materials, the careful transfer process, and the distinct benefits that an escrow arrangement brings to each party. With an overview of various release procedures, types of escrows, and verification options, this webpage serves as a foundational resource for professionals looking to secure their intellectual property and investments in the rapidly evolving software industry.

Parties to a Software Escrow

Parties to a Software Escrow

- A software escrow is an arrangement involving an Owner, a Beneficiary, and an Escrow Agent, such as EscrowTech.

- The Owner is a licensor, developer, or vendor who licenses or provides software to the Beneficiary.

- The Beneficiary is the licensee, customer, or other user of the software.

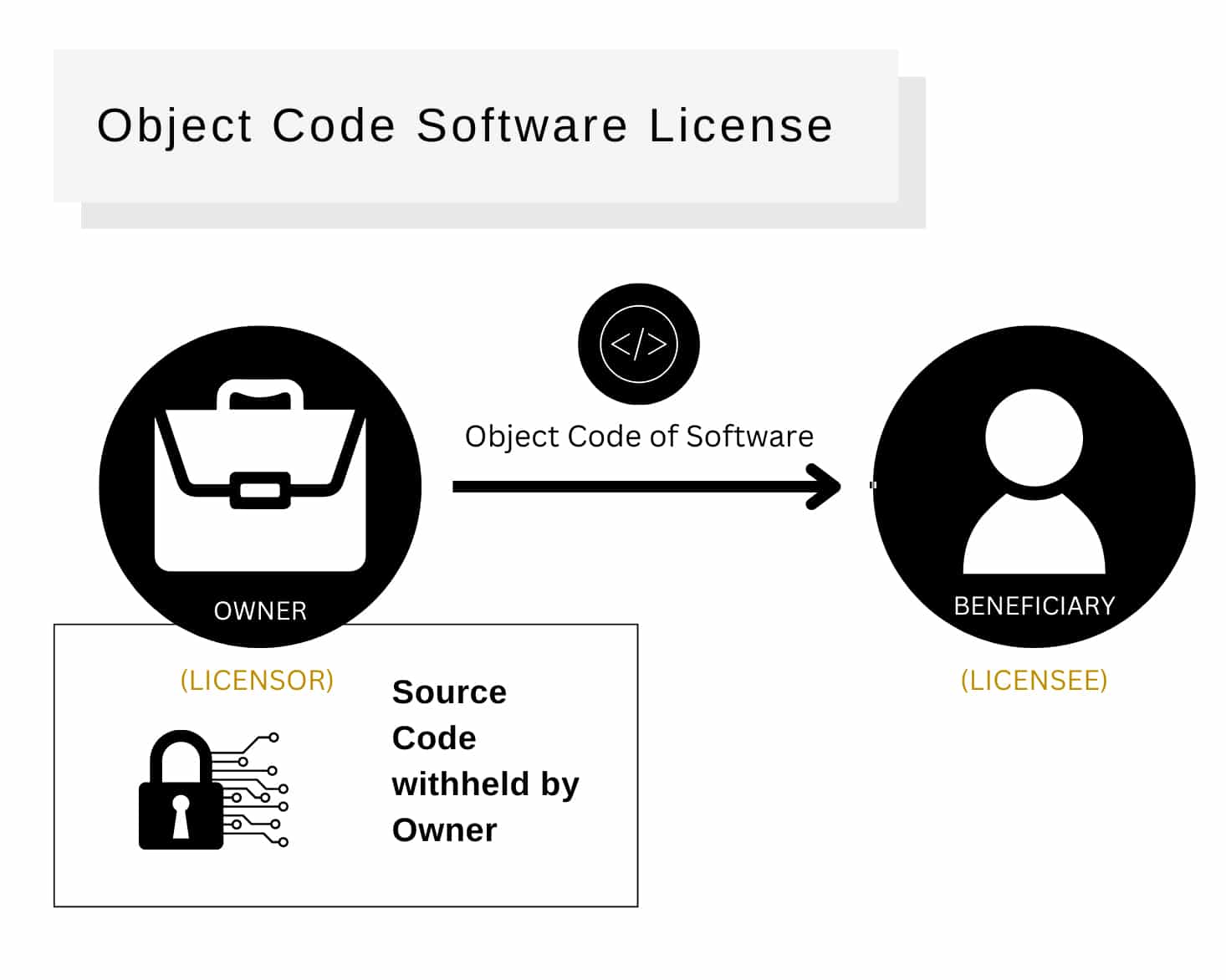

Background: Object Code Software License

- Owner and Beneficiary are parties to a License Agreement that licenses Beneficiary to use the object code of the licensed software. Beneficiary may also receive user manuals.

- Typically, Beneficiary does not receive the source code of the software or other proprietary materials that may be necessary or useful for maintaining, updating, or enhancing the software.

- This source code (and possibly other proprietary materials) is placed into escrow with the Escrow Agent.

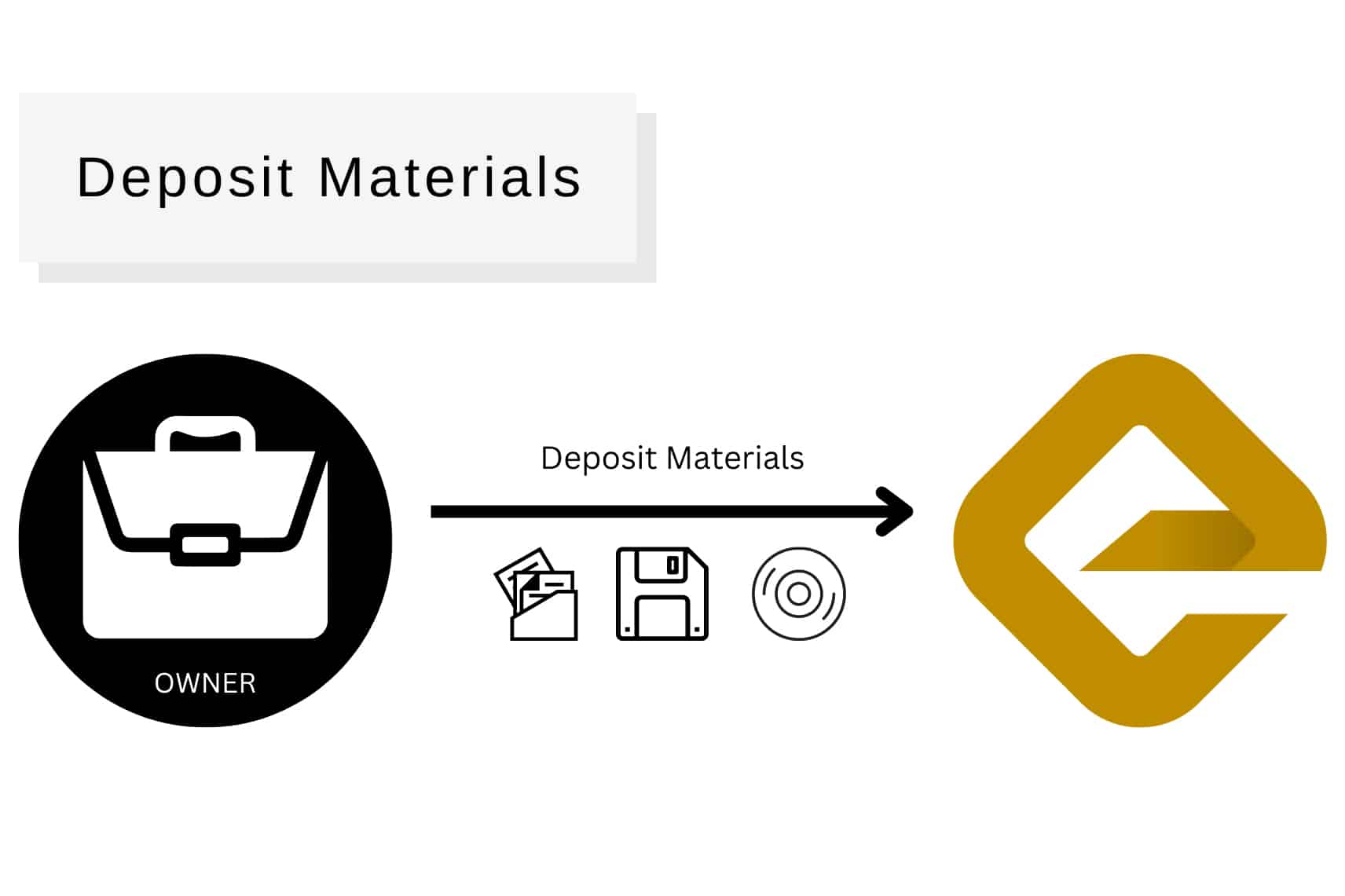

Deposit Materials

Deposit Materials

- Owner and Beneficiary agree on the items to be placed into the software escrow.

- These items are referred to as the “Deposit Materials” and include, at a minimum, the source code.

- Owner may agree to also include other proprietary materials as part of the Deposit Materials, e.g., programming documentation, build instructions, software tools, utilities, and/or other items.

- The Deposit Materials are delivered by Owner to the Escrow Agent who holds them in escrow in accordance with the Software Escrow Agreement.

- Owner should keep the Escrow current by depositing updated Deposit Materials to keep them current with the licensed software. Deposits typically are made quarterly, however EscrowTech has the technical capabilities to receive deposits daily. As an additonal service EscrowTech will copy all deposit materials on M-Disc – 1000 year plus rated storage media.

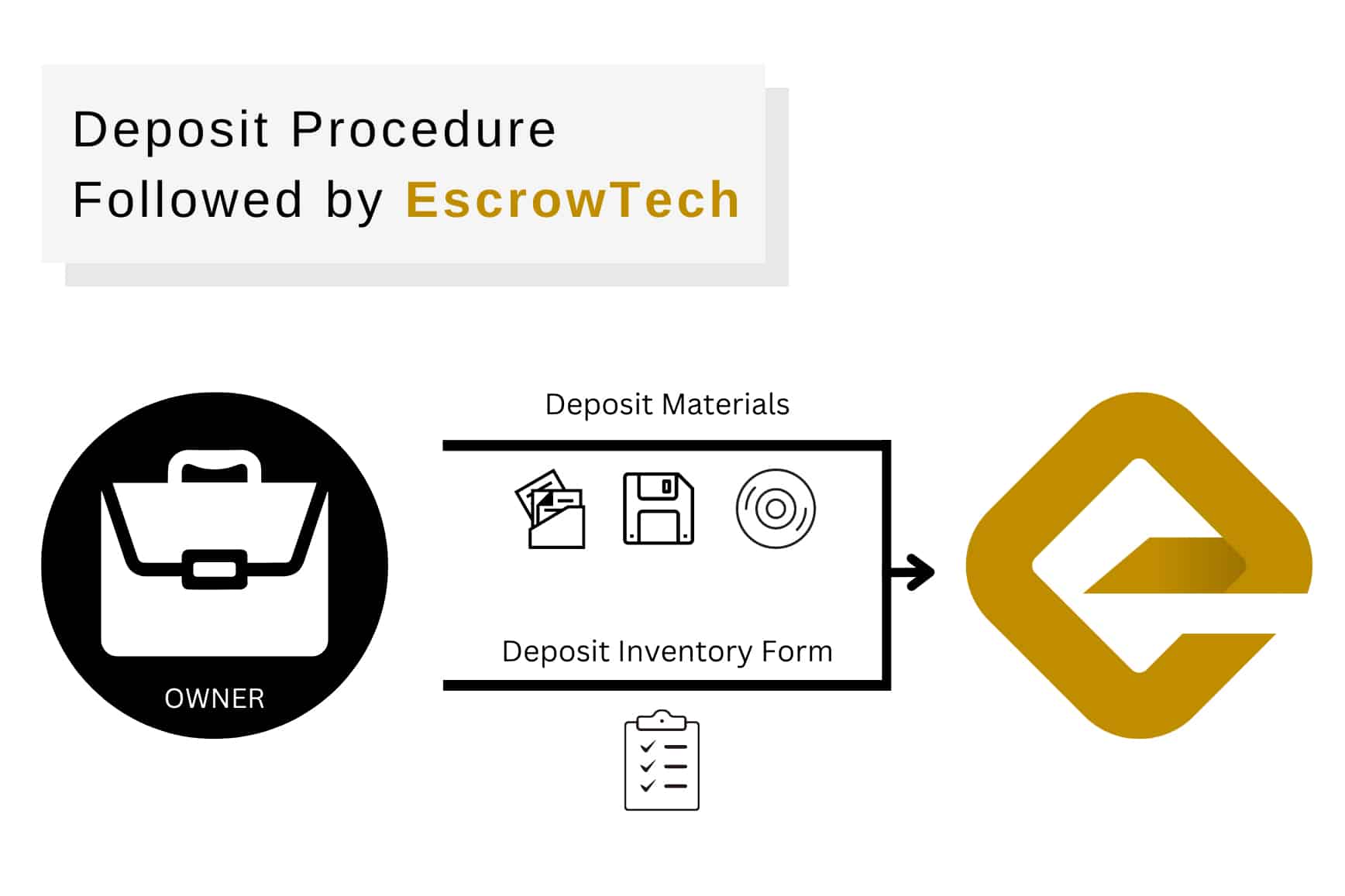

Deposit Procedure Followed by EscrowTech

- Owner delivers the Deposit Materials to EscrowTech.

- Owner includes a Deposit Inventory Form with the Deposit Materials. The Deposit Inventory Form identifi es the Deposit Materials and is signed by Owner.

- The Deposit Inventory Form is the Owner’s representation to the Beneficiary and EscrowTech that the Deposit Materials include the content identified in the Deposit Inventory Form.

- Clients can securly upload and transmit Deposit Materials and Deposit Inventory Form online through RealTime Escrow (EscrowTech’s Online Account Management Portal) to EscrowTech. Deposit Materials may also be sent by a commercial courier (e.g., Federal Express, UPS, Airborne, etc.) or by mail.

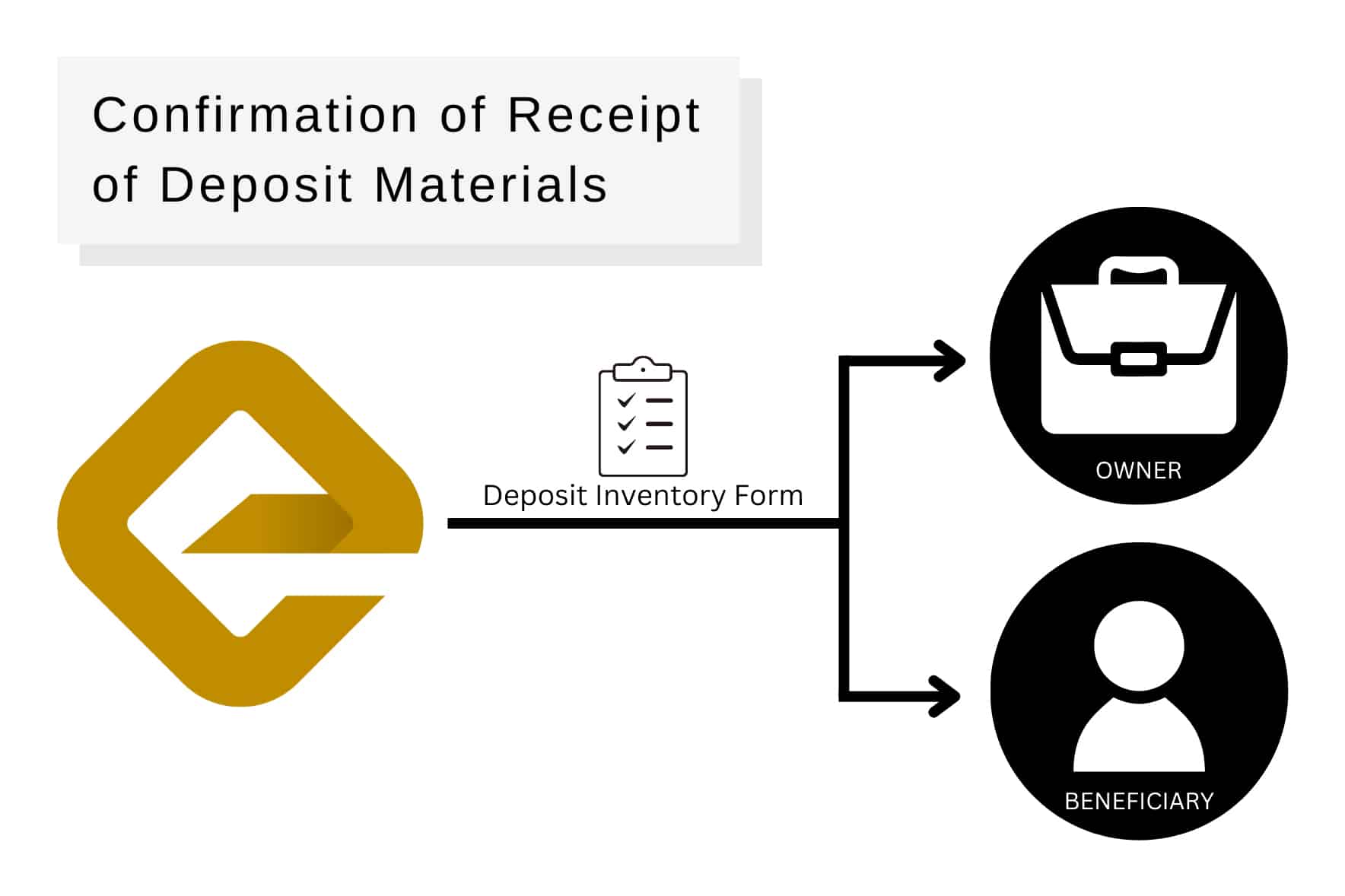

Confirmation of Receipt of Deposit Materials

- After EscrowTech receives the Deposit Materials and Deposit Inventory Form, they are processed by EscrowTech’s office.

- EscrowTech then sends a “Confirmation of Receipt of Deposit Materials” to the Owner and the Benefi ciary via mail and email. A copy of the Deposit Inventory Form accompanies the Confirmation.

- The Deposit Materials are then stored in secure facilities for long term safekeeping for the duration of the escrow. EscrowTech also offers RealTime Escrow, an online account access system, which contains a status report for each account with a deposit history log. Clients can use RealTime Escrow to confi rm that EscrowTech has the most up to date deposit materials. Clients can even sign up for EscrowTracker and receive automatic notices if the account has not been updated with deposits according to their contractual arrangement.

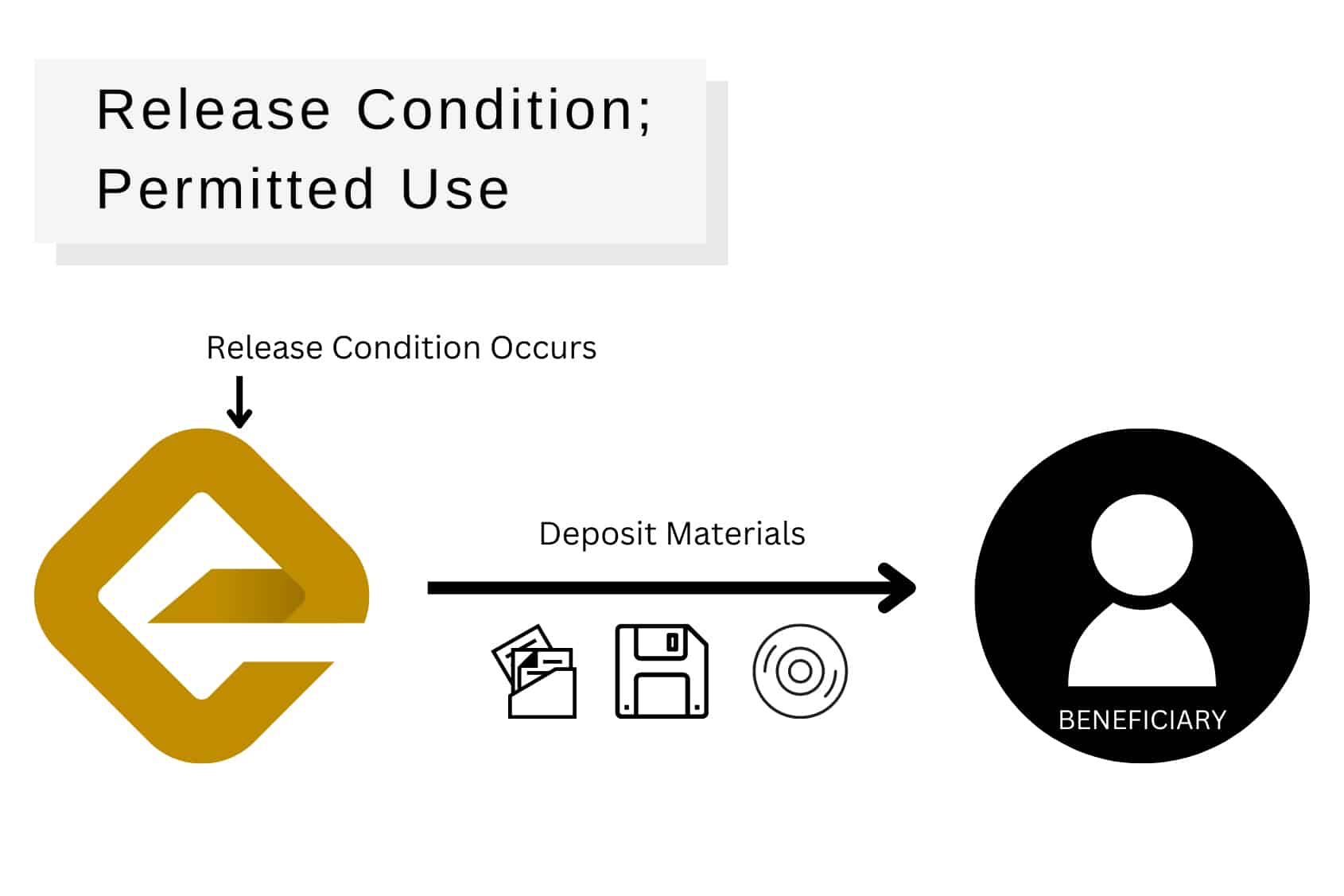

Release Condition; Permitted Use

- Upon the occurrence of an agreed upon “Release Condition” (e.g. the Owner goes out of business, the Owner’s bankruptcy, the Owner’s breach of its maintenance obligations, etc.), the Deposit Materials are released by Escrow Agent to the Beneficiary. Owner and Beneficiary decide what the Release Conditions will be.

- The released Deposit Materials may be used by the Beneficiary for a “Permitted Use” (e.g., to maintain, modify, update and enhance the software).

Benefits

How a Licensee Benefits

- A licensee’s business may depend on software licensed from a licensor.

- A knowledgeable licensee is concerned about timely maintenance of the software to correct programming errors and about updating or enhancement of the software to meet changing needs.

- Typically, the licensee does not have the source code or other proprietary materials needed or useful for maintaining, updating or enhancing the software, and therefore is dependent upon the licensor to maintain, update and enhance the software.

- If the licensor goes out of business, or fails to maintain, update or enhance the software, the licensee may suffer significant interruption of, or damage to, its business.

- As a “Beneficiary” to a software escrow, the licensee will receive the Deposit Materials if a Release Condition (e.g., bankruptcy, breach of maintenance agreement, etc.) occurs and will have the right to use them to maintain, update and enhance the software.

How a Licensor Benefits

- By establishing an escrow, the licensor can address the concerns of its prospective licensees without exposing the licensor to the risks inherent in distributing source code and other proprietary materials to licensees.

- Even under non-disclosure obligations, the proliferation of source code and other proprietary materials to licensees makes it difficult or impossible to ensure against eventual disclosure to competitors or loss of trade secret rights.

- By using an escrow as an “Owner”, the licensor can make its software more marketable and can use the escrow as a selling point to prospective licensees.

- Having an escrow already in place, can eliminate needless negotiation over source code rights and can prevent delays in getting the deal done!

- An escrow also creates a partial intellectual trail for the licensee.

Release Procedure

Typical Release Procedure

- If a Release Condition occurs, the typical release procedure includes the following.

- Request for Release. Beneficiary informs the Escrow Agent that the Release Condition has occurred and requests that the Deposit Materials be released by the Escrow Agent to Beneficiary. The Escrow Agent then gives notice of the request to Owner. Owner has a specifi ed period of time (e.g., two weeks) to object if Owner believes that the Release Condition has not occurred. If an objection is not made within this time period, then the Escrow Agent releases the Deposit Materials to Beneficiary.

- Objection. If Owner objects (e.g., disputes that a Release Condition has occurred), then the Deposit Materials are retained by the Escrow Agent and the matter is resolved by arbitration between Beneficiary and Owner or by other agreed upon means of dispute resolution. The Deposit Materials will not be released unless the arbitration or other dispute resolution concludes that the Beneficiary is entitled to a release of the Deposit Materials.

Mandatory Release Procedure (For Immediate Release)

- If a Beneficiary is concerned about the delay that may be caused by an Owner’s objection to a release of Deposit Materials, the Beneficiary and Owner may agree to a Mandatory Release procedure as an alternative to the Typical Release Procedure.

- A “Mandatory Release” procedure provides for an immediate release of Deposit Materials to Beneficiary upon Beneficiary’s written demand for a release and Beneficiary’s representation to the Escrow Agent that a Release Condition has occurred.

- If Owner objects to the release, the issue will be resolved by arbitration or other dispute resolution means, but such objection does not delay or prevent the release of Deposit Materials to Beneficiary.

- If it is resolved that the release was improper (e.g., the Release Condition did not occur), then Beneficiary must return the Deposit Materials to the Escrow Agent and must pay damages, if any, suffered, and attorneys’ fees and costs incurred, by Owner. If it is resolved that the release was proper (e.g., the Release Condition did occur), then Beneficiary may retain the Deposit Materials and Owner must pay attorneys’ fees and costs incurred by Beneficiary.

- Variations on this procedure and other creative solutions are possible.

Released Deposit Materials

- The Escrow Agreement typically provides for the protection of the Deposit Materials if they are released to the Beneficiary.

- Regardless of the release procedure followed (see above), the Beneficiary should only be allowed to use the released Deposit Materials in accordance with the Permitted Use.

- The Beneficiary should also be obligated to keep the released Deposit Materials confidential. However, Beneficiary may be given the right to use independent contractors to help Benefi ciary use the released Deposit Materials for the Permitted Use. This may include the right to “team up” with other Beneficiaries to share resources and programmers (or a maintenance service).

- The Software that is maintained, updated or enhanced with the use of the Deposit Materials should be used only in accordance with the License Agreement between the Owner (licensor) and Beneficiary (licensee).

Technology Escrows

- “Technology Escrows” are essentially the same as Software Escrows, except that the Deposit Materials are not necessarily software related.

-

EscrowTech can do escrows for any kind of situation, e.g., SAAS or hosted environments, ecommerce, intellectual property licensing in any area (chemical, biotech, electrical, mechanical, etc.), architecture, products, etc.

- The “Deposit Materials” placed into this escrow can be any technology, information, data, encryption keys, passwords, drawings, documents, prototypes, samples, formulas, or materials you desire, provided that they are safe and legal.

Types of Escrows

Types of Escrows offered by EscrowTech

A Software or Technology Escrow can include just one Beneficiary or can be designed to accommodate two or more Beneficiaries. Escrows can be customized to accommodate other situations and a variety of Deposit Materials.

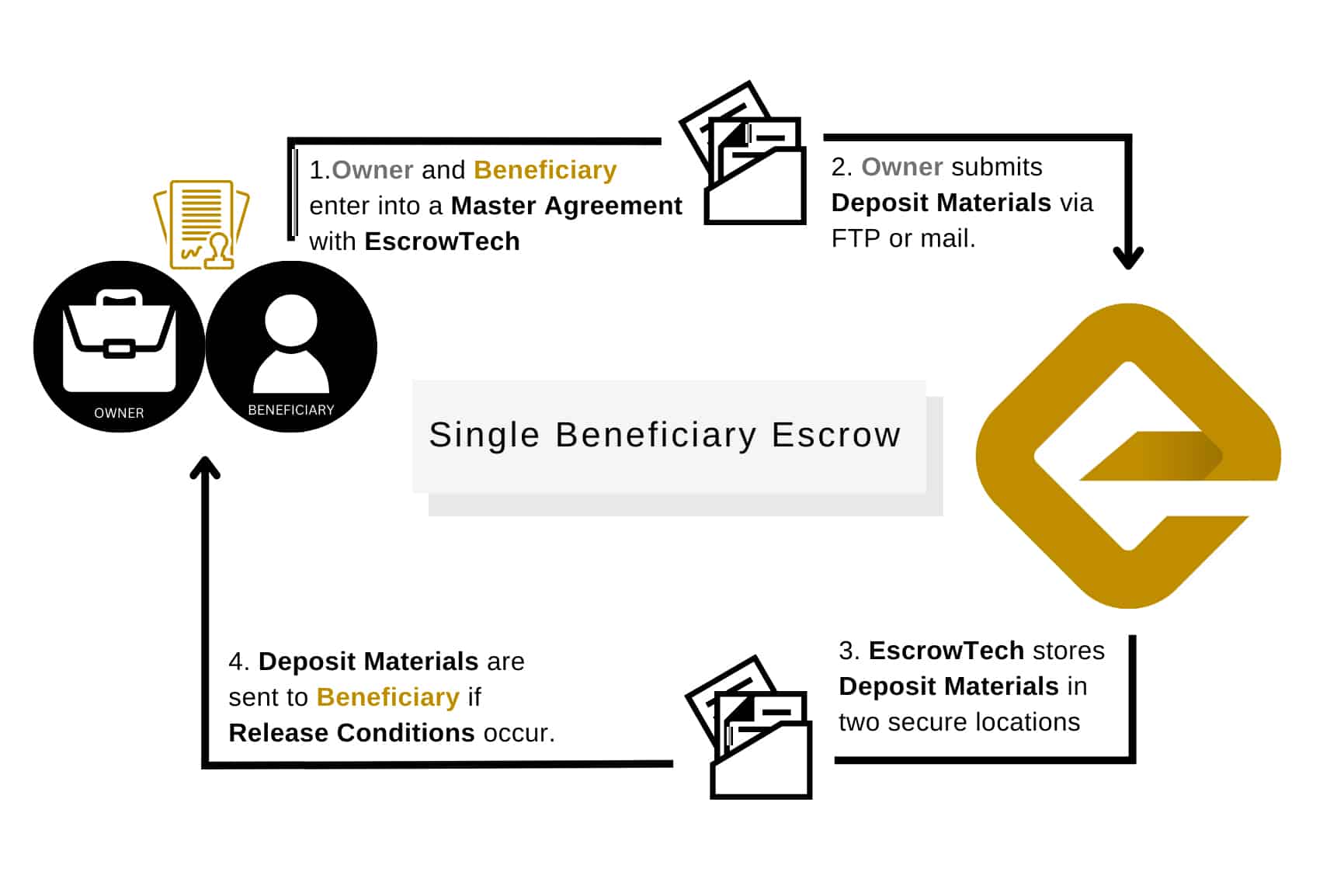

Type 1: "SB" Escrow: Single Beneficiary

- Only one Beneficiary.

- The Escrow Agreement is a “three party” agreement signed by the Owner, Beneficiary and EscrowTech.

- The Beneficiary is a party to the Agreement and can enforce it.

- The Agreement defines the Deposit Materials, Release Condition and Permitted Use.

- The Deposit Materials are dedicated to that Beneficiary, and not shared with or held for other Beneficiaries.

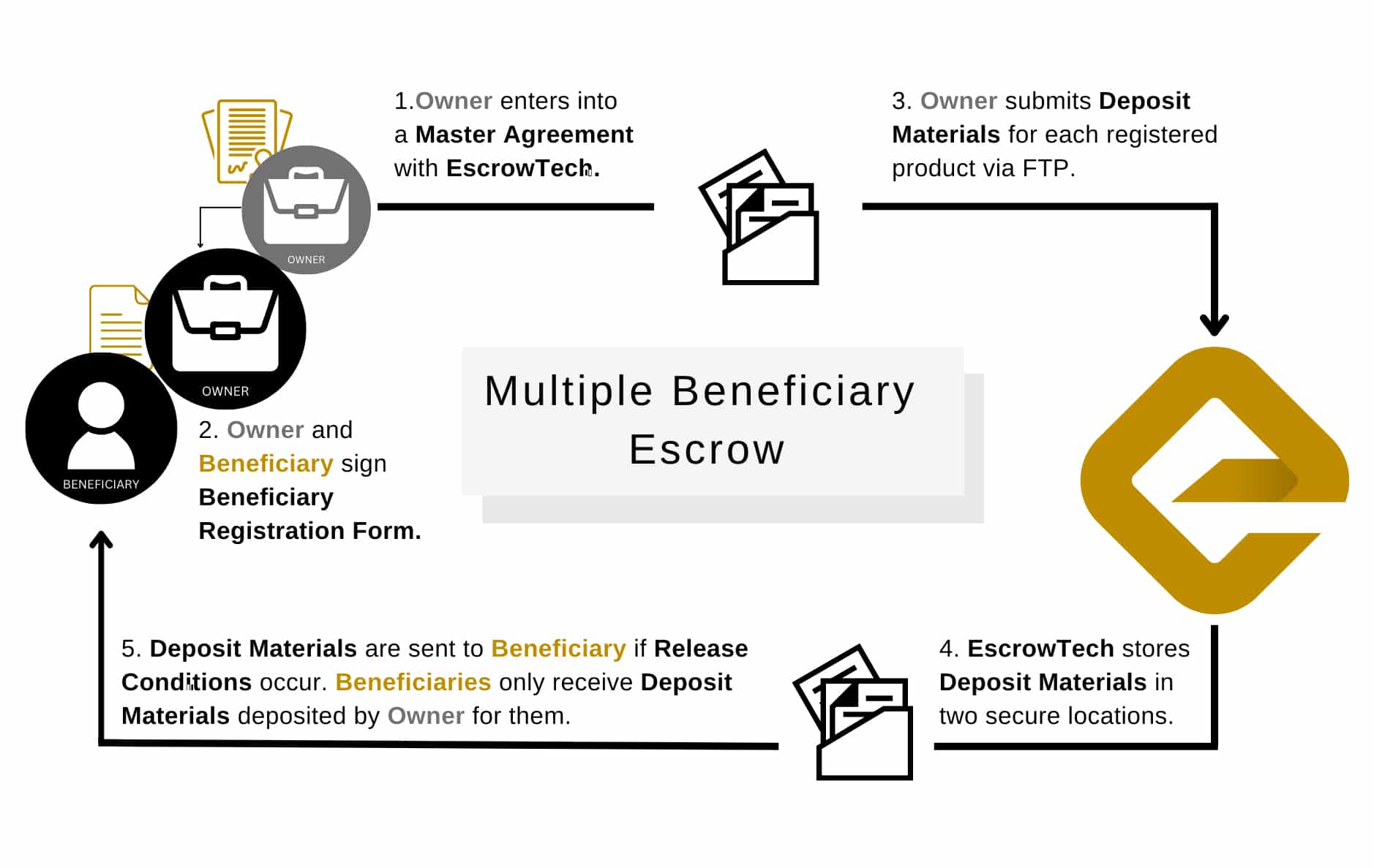

Type 2: "MB" Escrow: Multiple Beneficiaries—Unseparated Products

- Two or more Beneficiaries under the same escrow.

- The Escrow Agreement is signed by Owner and EscrowTech.

- Licensees are registered as Beneficiaries. To register, both the licensee and Owner sign a Beneficiary Registration Form and deliver it to EscrowTech. EscrowTech confirms each registration to the Beneficiary and Owner. A single software escrow serves all of the Beneficiaries.

- The Agreement defi nes the Deposit Materials. The Deposit Materials are the same for each Beneficiary.

- A Beneficiary’s Beneficiary Registration Form defines the Release Condition and Permitted Use for that Beneficiary. The Release Condition and Permitted Use may be different for different Beneficiaries.

- For this type of escrow, the software licensed to the Benefi ciaries should be the same.

- The Owner may include one or more software products in this type of escrow, but the Deposit Materials are not separated by product, i.e., the Deposit Materials for all such software products may be released to each Beneficiary if a release occurs.

- This type of escrow should not be used unless all Beneficiaries are licensed to use all of the software products for which Deposit Materials are placed into the escrow. Otherwise, upon the occurrence of the Release Condition some Beneficiaries may receive source code or other Deposit Materials for software not licensed to them. To solve this problem, use the MB-SP Escrow described below – where Deposit Materials are separated by product and Beneficiaries are registered by licensed product.

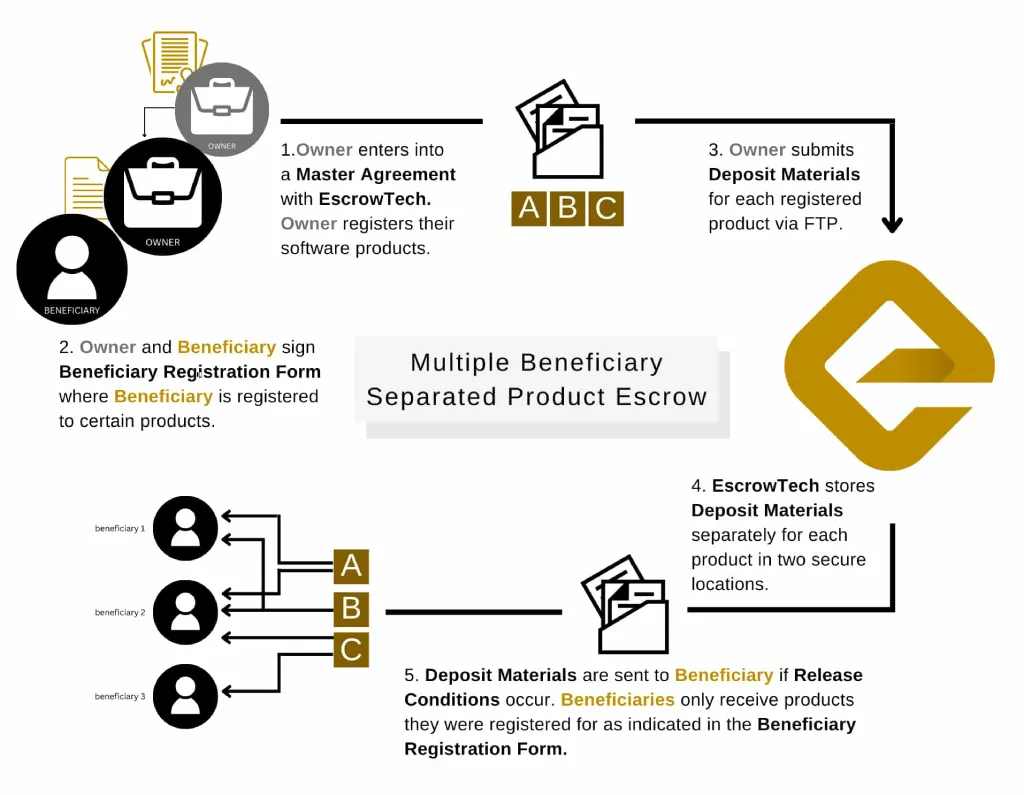

Type 3: “MB-SP” Escrow: Multiple Beneficiaries—Separated Products

- This type of escrow is useful if the Owner offers a plurality of software products, but not all products are licensed to each and every Beneficiary.

- This type of escrow is similar to the “MB” Escrow previously described, but is modified to limit a Beneficiary’s escrow rights to those products licensed to that Beneficiary.

- One Escrow Agreement will govern all of the software products listed in the Agreement and all of the Beneficiaries registered under the Agreement.

- Owner may at any time add additional software products to the escrow and Agreement.

- The Benefi ciary registration procedure is similar to the procedure described for the “MB” Escrow.

- Each Beneficiary Registration Form indicates which software products are licensed to the Benefi ciary. Each Beneficiary registers under the escrow only for the software products licensed to it and will have no right to receive Deposit Materials for other unlicensed software products.

- Different Beneficiaries may be registered for different combinations of the Owner’s software products. Thus, a single escrow and single escrow agreement accommodates many products and eliminates the complexity and expense of multiple escrows.

- Owner separately submits to EscrowTech the Deposit Materials for each software product. A separate Deposit Inventory Form is used for each product.

- A separate set of Deposit Materials for each product is placed into escrow.

- EscrowTech keeps the Deposit Materials for each software product separate from the Deposit Materials for other software products.

- If a Beneficiary becomes entitled to a release, the Beneficiary will only receive the Deposit Materials for the software products for which the Beneficiary is registered.

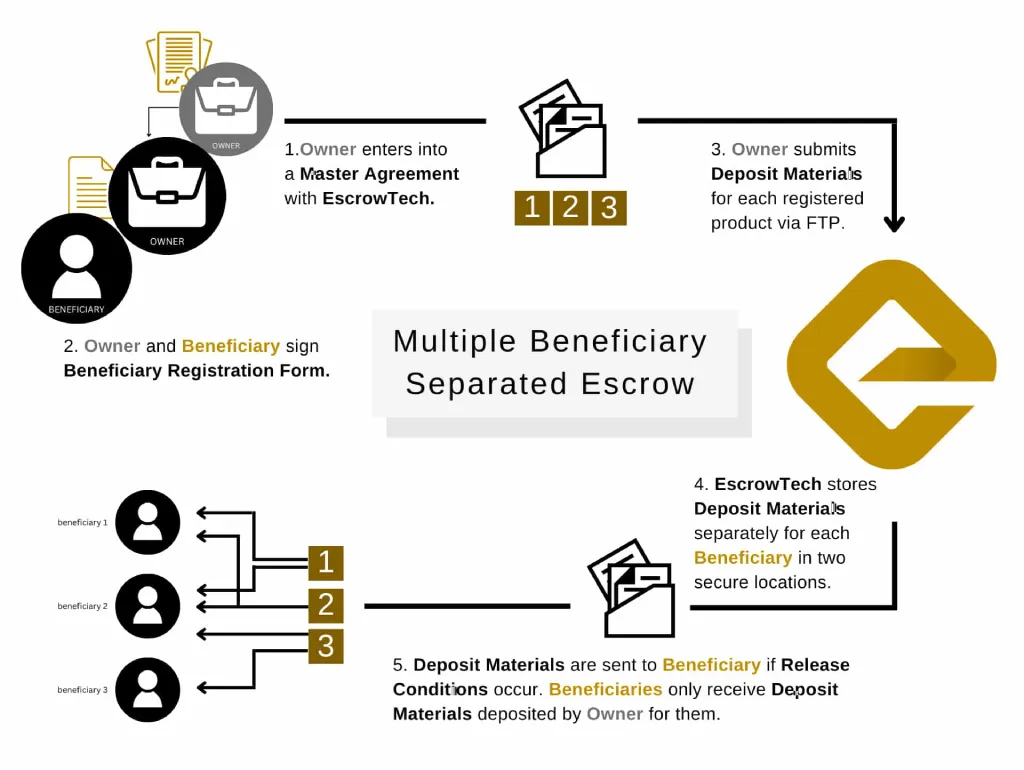

Type 4: "MB-SE” Escrow: Multiple Beneficiaries—Separate Escrows

- This type of escrow is useful if different software or different versions or customizations of the software are licensed to different Beneficiaries.

- Under such circumstances, the Deposit Materials needed by Beneficiary #1 will be different from the Deposit Materials needed by Beneficiaries #2, #3, etc. Therefore, separate escrows of different Deposit Materials are needed.

- This type of escrow is similar to the “MB” Escrow previously described, but is modified by providing that a separate escrow is established for each Beneficiary and its unique set of Deposit Materials.

- One Escrow Agreement is signed by the Owner and EscrowTech. This one Agreement will govern all of the escrows established under the Agreement and all of the Beneficiaries registered under the Agreement.

- Owner may include as many software products as it desires to the escrow of a given Beneficiary at no extra cost.

- The Beneficiary registration procedure is similar to the procedure described for the “MB” Escrow. The primary difference is that the Beneficiary Registration Form will identify the Deposit Materials applicable to that Beneficiary.

- Each Beneficiary registers under the escrow only for the Deposit Materials designated for that Benefi ciary and its escrow. The Beneficiary will have no right to receive Deposit Materials for other Beneficiaries.

- Owner separately submits to EscrowTech the Deposit Materials for each Beneficiary. A separate Deposit Inventory Form is used for each Beneficiary.

- In this manner, a separate set of Deposit Materials for each Beneficiary is placed into a separate escrow for that Beneficiary only.

- EscrowTech keeps the Deposit Materials for each Beneficiary separate from the Deposit Materials for other Beneficiaries.

- If a Beneficiary becomes entitled to a release, the Beneficiary will only receive the Deposit Materials for which the Beneficiary is registered.

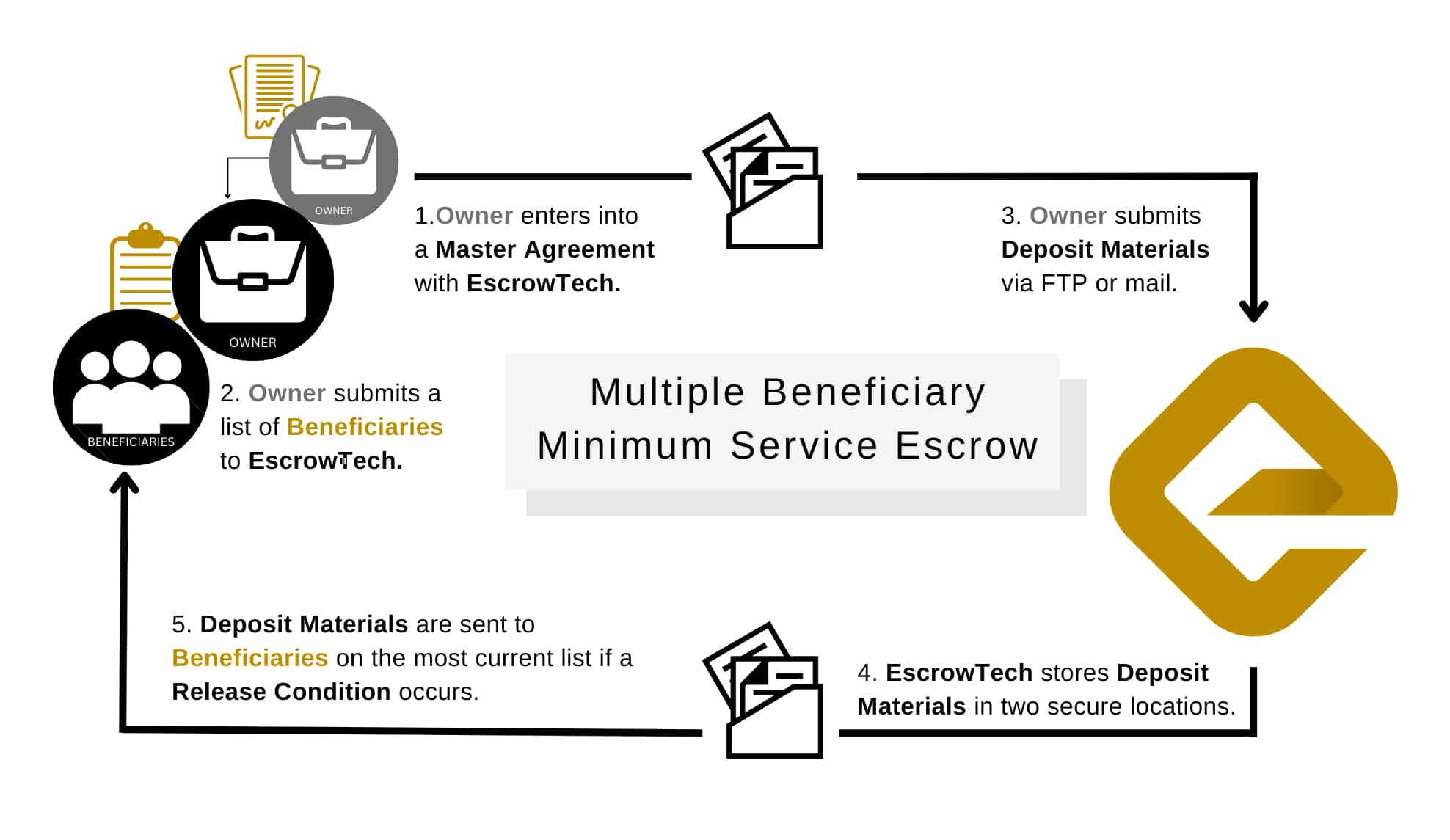

Type 5: “MB-Min” Escrow: Multiple Beneficiaries—Minimum Service

- This type of escrow is useful if there are many Benefi ciaries and Owner desires to eliminate the need and expense of a separate registration process for each Beneficiary.

- This type of escrow is similar to the MB Escrow previously described, but the Beneficiary Registration Form is not used.

- To register its licensees, Owner simply submits a list of Beneficiaries to EscrowTech.

- Owner can add or delete Beneficiaries by submitting a new List of Beneficiaries to EscrowTech. The new list will replace all previous lists.

- The List of Beneficiaries can include as many Beneficiaries as Owner desires to list. There is no additional charge.

- Beneficiaries are at risk of being removed from the Escrow, i.e., they might not be included by Owner on the next List of Beneficiaries.

- The Release Condition and Permitted Use are specified in the Escrow Agreement and are the same for all Beneficiaries. [Note: In the other “Multiple Beneficiaries” escrows, the Release Condition and Permitted Use can be written differently for each Benefi ciary.]

- If the Release Condition occurs, then each Beneficiary on the then-current List of Beneficiaries will be entitled to receive a copy of the Deposit Materials.

- Beneficiaries are not parties to the Escrow Agreement and will not receive notices when new Deposit Materials (“Updates”) are deposited into the escrow.

- A legally sophisticated Beneficiary may not view this as adequate protection, but it is far better than no escrow protection and may be the most practical solution for widely licensed, low cost software.

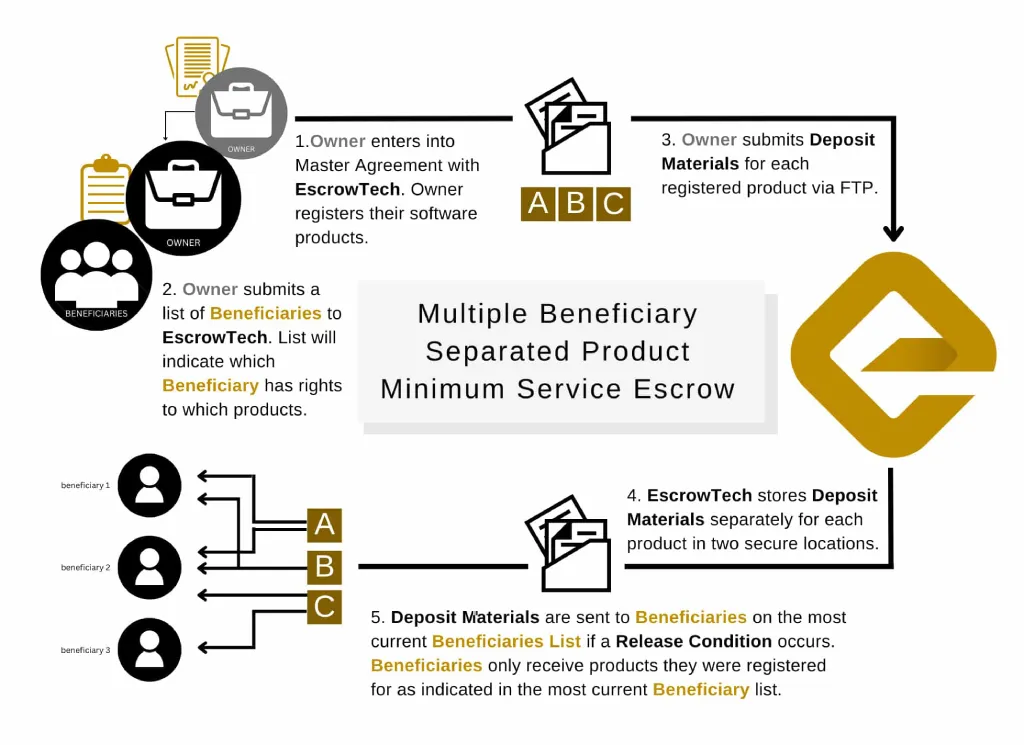

Type 6" “MB-Min-SP” Escrow: Multiple Beneficiaries—Minimum Service—Separated Products

- This type of escrow is useful if there are many Benefi ciaries and Owner desires to eliminate the need and expense of a separate registration process for each Beneficiary.

- This type of escrow is similar to the MB Escrow previously described, but the Beneficiary Registration Form is not used.

- To register its licensees, Owner simply submits a list of Beneficiaries to EscrowTech.

- Owner can add or delete Beneficiaries by submitting a new List of Beneficiaries to EscrowTech. The new list will replace all previous lists.

- The List of Beneficiaries can include as many Beneficiaries as Owner desires to list. There is no additional charge.

- Beneficiaries are at risk of being removed from the Escrow, i.e., they might not be included by Owner on the next List of Beneficiaries.

- The Release Condition and Permitted Use are specified in the Escrow Agreement and are the same for all Beneficiaries. [Note: In the other “Multiple Beneficiaries” escrows, the Release Condition and Permitted Use can be written differently for each Beneficiary.]

- If the Release Condition occurs, then each Beneficiary on the then-current List of Beneficiaries will be entitled to receive a copy of the Deposit Materials.

- Beneficiaries are not parties to the Escrow Agreement and will not receive notices when new Deposit Materials (“Updates”) are deposited into the escrow.

- A legally sophisticated Beneficiary may not view this as adequate protection, but it is far better than no escrow protection and may be the most practical solution for widely licensed, low cost software.

- Deposit Materials are deposited and held separately for each product relevant to the escrow. The List of Beneficiaries will indicate which products are licensed to each Beneficiary (the “registered products”). In the event of a release of Deposit Materials to a Beneficiary, the Beneficiary will only be entitled to receive a copy of the Deposit Materials corresponding to the products registered to it.

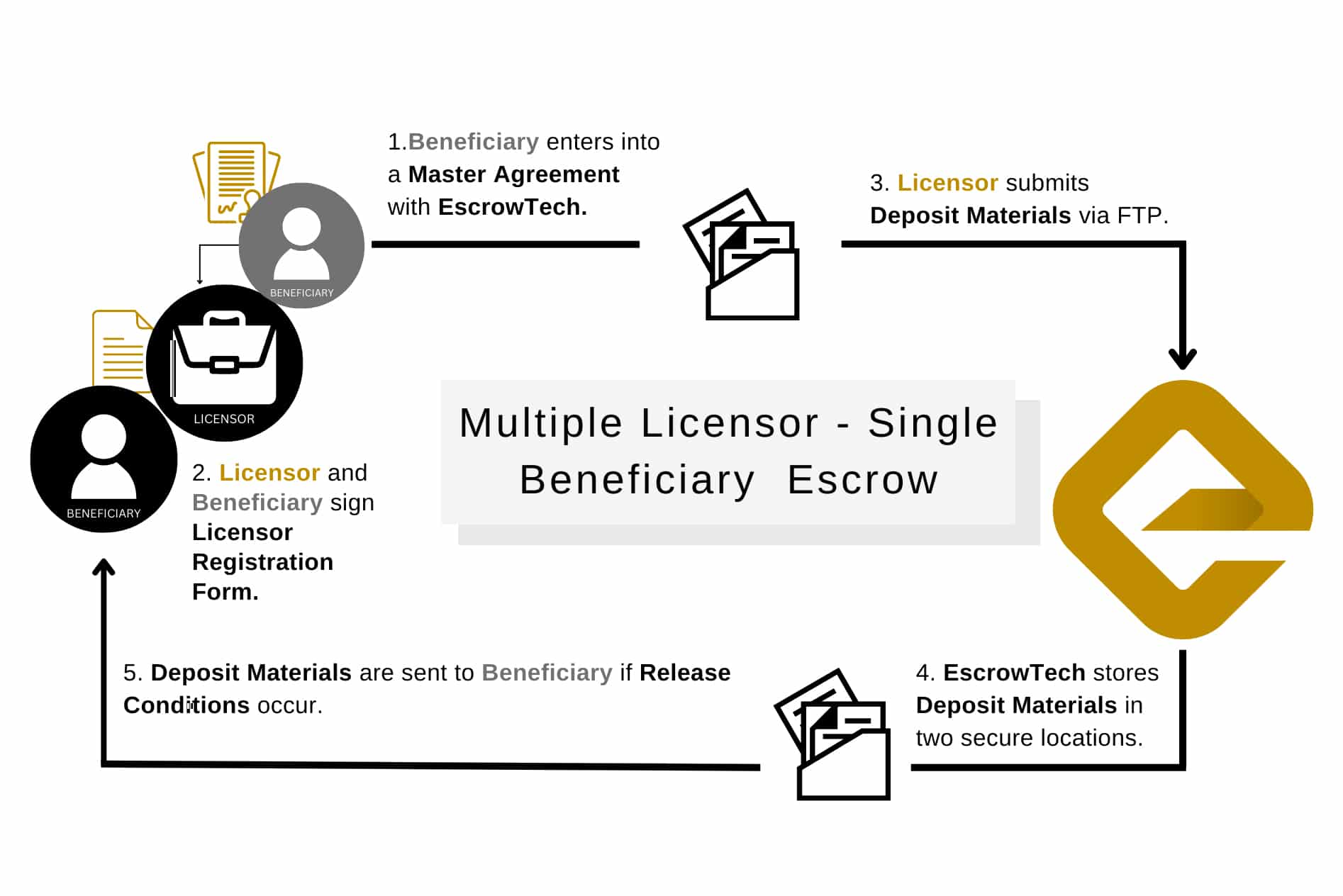

Type 7: “ML-SB” Escrow: Multiple Licensor—Single Beneficiary

- A company that licenses various software products from various software licensors may desire to have a single escrow agent selected by the company serve as the escrow agent for the source code and other Deposit Materials for the software products it licenses from these licensors.

- The company in this case is the “Beneficiary” and the licensors are the “Licensors.”

- There is only one Beneficiary.

- Each Licensor is in effect an “Owner” as described above and deposits its source code and other Deposit Materials into the escrow.

- An Escrow Agreement is signed by the Benefi ciary and EscrowTech.

- Each participating licensor is registered as a “Licensor” with EscrowTech by delivering a signed Licensor Registration Form to EscrowTech.

- Each Licensor Registration Form describes the Deposit Materials, Release Condition, and Permitted Use applicable to the Licensor and its software.

- Each Licensor separately submits its Deposit Materials to EscrowTech. A separate Deposit Inventory Form is used by each Licensor.

- In this manner, a separate set of Deposit Materials from each Licensor is placed into a separate escrow corresponding to that Licensor only.

- EscrowTech keeps the Deposit Materials from each Licensor separate from the Deposit Materials for other Licensors.

- If the Release Condition applicable to a Licensor occurs, Benefi ciary will only receive the Deposit Materials from the escrow for that Licensor, and is not entitled to other Deposit Materials in the other escrows.

Standard Inspection

Standard Inspection

Standard Inspection of Deposit Materials

- Each time Owner submits Deposit Materials to EscrowTech, Owner provides a Deposit Inventory Form with the Deposit Materials.

- The Deposit Inventory Form is signed by a representative of Owner and is Owner’s representation to Beneficiary and EscrowTech that the tangible media (e.g., CD ROMs, magnetic tapes, etc.) containing the Deposit Materials do in fact contain the Deposit Materials described or identifi ed on the Deposit Inventory Form.

- EscrowTech will send to Owner and Beneficiary a written confi rmation that the Deposit Materials have been received. This confirmation will be accompanied by a copy of the Deposit Inventory Form.

- EscrowTech conducts a Physical Audit of the Deposit Materials which consists of reviewing the Deposit Inventory Form and visually checking the tangible media containing the Deposit Materials for any discoverable discrepancy with the form.

- A discovered discrepancy will be reported in writing to both the Owner and the Beneficiary.

- This does not include an examination of the code or other content of the tangible media.

Released Deposit Materials

- Technical Verification Services are optional and are in addition to Standard Verifi cation of Deposit Materials.

- Both Owner and Beneficiary must agree on technical verification. EscrowTech will not subject Deposit Materials to any technical verification not agreed to by both Owner and Beneficiary.

- These services can be used to verify that the Deposit Materials placed into the escrow meet the technical requirements of the agreement, are as represented by Owner, are suffi cient to recreate the executable program, or meet other agreed upon standards or conditions.

- Different levels of technical verifi cation services are available from EscrowTech to meet the needs of our clients. Because of the different levels of verifi cation and other complexities, technical verifi cation services are scoped and priced on a case by case basis.

- An EscrowTech technical verification specialist will consult with Owner and Beneficiary to determine the scope and level of technical verification desired.

Technical Verfication Options

- Technical Verification of Deposit Materials is recommended and can be performed in conjunction with a Software Escrow or as a separate service.

- EscrowTech performs a standard Physical Audit on all Deposits made to a Software or Technology Escrow. The Physical Audit consists of reviewing the Deposit Inventory Form and visually checking the tangible media containing the Deposit Materials for any discoverable discrepancy with the form. A discovered discrepancy will be reported in writing to both the Owner and the Beneficiary. Additional verifi cation of the Deposit Materials can be requested by either party according to the options outlined below. For more details visit the Technical Verification webpage.

- Level 1 – File Listing Verification Report

- Level 2 – Technical Verification – Deposit Analysis

- Level 3 – Technical Verification – Build and Compile

- Level 4 – Technical Verification – Binary Comparison

- Level 5 – Technical Verification – Test Plan

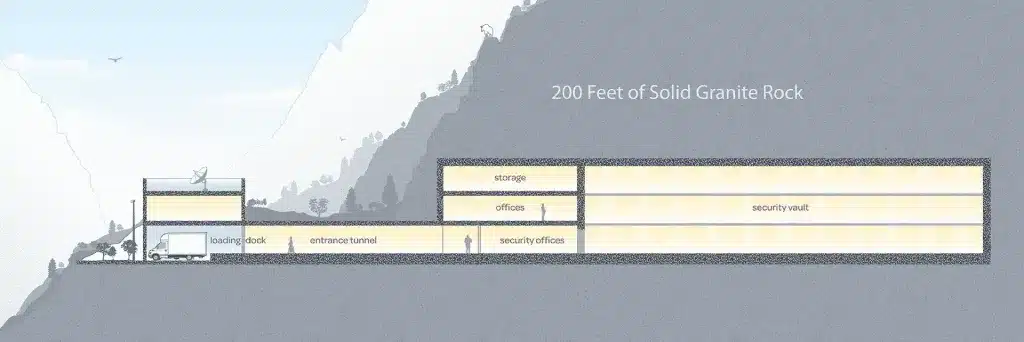

One copy or set of the Deposit Materials is stored in a dedicated, secure vault within the Technology Law Center. A second copy or set of the Deposit Materials is stored in EscrowTech’s space within the Perpetual Storage Vault located in Little Cottonwood Canyon near Salt Lake City